The speculation and vacancy tax is here and there's no way to ignore it, if fact, our new government has made a point to make sure nobody can ignore it unless you don't mind forking over several thousand dollars.

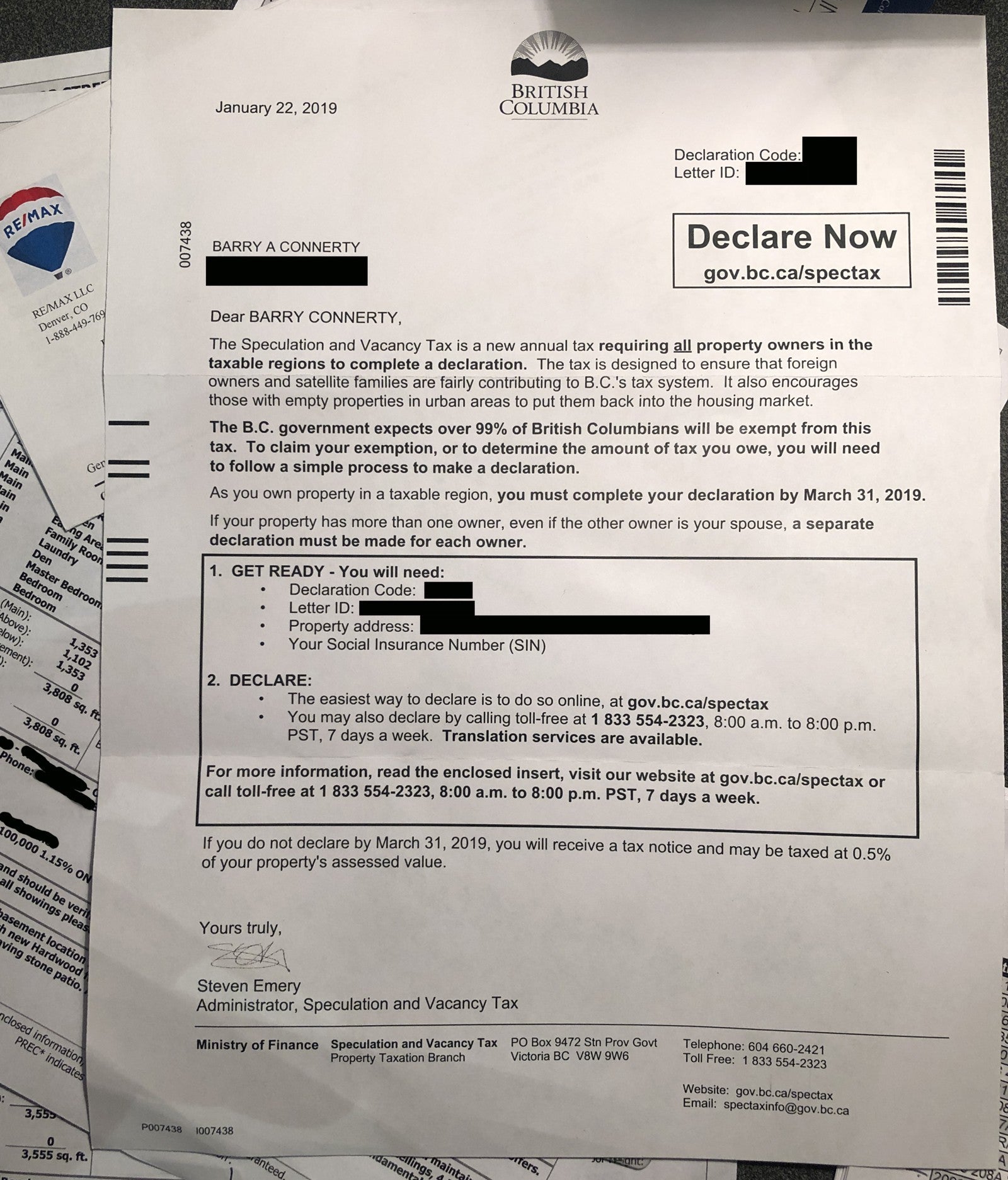

I received my tax letter yesterday.

The NDP has initiated this tax with the idea to simplify things but, in what seems like a rookie mistake, they have made things more complex for those who shouldn't be bothered which by their own estimate is 99% of us. They've done this by making the system a negative style billing system. That means that they will charge you the tax (yes you!) and it's up to you to opt out. And you have to opt out before March 31. Oh, and if you share title with someone else - they have to opt out as well. So if your spouse or your parents or kids or anyone else is on title with you make sure they sign up, and fill out the correct forms.

The nice thing is that you can do the whole thing online and it's rather quick and easy. I as able to fill out the whole declaration for both myself and my wife in under 10 minutes. You can go directly to the declaration page by clicking HERE. Make sure that you have your letter handy as you'll need the Declaration Code as well as the Letter ID found at the top right hand corner of the letter and also in the centre of the body of the letter. The Declaration Code is 5 (XXXXX) numbers and the Letter ID is 11 digits beginning with the letter "L" (LXXXXXXXXXX)

This new annual tax is designed to: To claim your exemption, you must register your property by March 31, 2019 – and it’s easy to do, either by phone or online. The information you’ll need to register your property declaration will be mailed by mid-February to all owners of residential property within the taxable regions. Contact us if you’re expecting a declaration letter from us and haven’t received one by late February.Please note that if your property has more than one owner, even if the other owner is your spouse, a separate declaration must be made for each owner.

To claim your exemption, you must register your property by March 31, 2019 – and it’s easy to do, either by phone or online. The information you’ll need to register your property declaration will be mailed by mid-February to all owners of residential property within the taxable regions. Contact us if you’re expecting a declaration letter from us and haven’t received one by late February.Please note that if your property has more than one owner, even if the other owner is your spouse, a separate declaration must be made for each owner.

- Target foreign and domestic speculators who own residences in B.C. but don’t pay taxes here

- Turn empty homes into good housing for people

- Raise revenue that will directly support affordable housing

How to Exempt Yourself

To claim your exemption, you must register your property by March 31, 2019 – and it’s easy to do, either by phone or online. The information you’ll need to register your property declaration will be mailed by mid-February to all owners of residential property within the taxable regions. Contact us if you’re expecting a declaration letter from us and haven’t received one by late February.Please note that if your property has more than one owner, even if the other owner is your spouse, a separate declaration must be made for each owner.

To claim your exemption, you must register your property by March 31, 2019 – and it’s easy to do, either by phone or online. The information you’ll need to register your property declaration will be mailed by mid-February to all owners of residential property within the taxable regions. Contact us if you’re expecting a declaration letter from us and haven’t received one by late February.Please note that if your property has more than one owner, even if the other owner is your spouse, a separate declaration must be made for each owner.How the Tax Will Be Charged If You're Not Exempt

The speculation and vacancy tax rate varies depending on the owner’s tax residency and whether the owner is a Canadian citizen or permanent resident of Canada, or a member of a satellite family. By levying the highest tax rate on foreign owners and satellite families (those who earn a majority of income outside the province and pay little to no income tax in B.C.), the speculation and vacancy tax is a way to make sure these property owners are paying their fair share in taxes.The speculation and vacancy tax applies based on ownership as of December 31 each year.Note: The speculation and vacancy tax is distinct from the empty homes tax in the City of Vancouver.Read our answers to questions on the speculation and vacancy tax and learn about how to declare, the taxable regions and the available exemptions.Subscribe to receive updates as new information about the speculation and vacancy tax becomes available.The official website is HERE

If you have any questions just give me a call and I'd be happy to help.